Your planner and Financial Goals

One of the layouts I designed was for tracking my monthly spending. Just like when we focus on what we are eating, writing things down helps you to get REAL about what you are doing with your money and hold yourself accountable. Getting on track with finances feels fantastic. Some months are better than others, but I always feel better in a month where I am tuned in and intentional. Thankfully, this practice has been really helpful to me. In January, I renewed my mortgage and looked at a realistic plan of how early I can pay it off. That was a moment of joy. I am a bit of a geek… getting joy and fun from budgets and working toward being debt free. But who doesn’t feel good about greater financial freedom?!?! 😊

Tips for using your planner for financial success ….

write down everything you spend

have a set of codes for types of expenses (G=groceries)

record date, code, store, $ amount

record income

record debt repayment and savings

tally everything at the end of the month

record totals in the annual finance tracker

At year end, tally all of the categories and see where you are spending the most and consider where you can reduce spending.

What really matters to you?

Are there ways that you can get what you want for less cost?

What did you spend money on that you could totally do without? Thinking about this will help you to more easily make a better financial choice next time.

I know that the tallying takes time, but it is so powerful. The awareness that comes from looking at you expenses every couple of days or even once a week really helps you to stay tuned in to your financial goals and intentions. After doing this for a full year, it was incredible how much more clearly I understood my own finances.

So much joy and financial freedom to you all!!

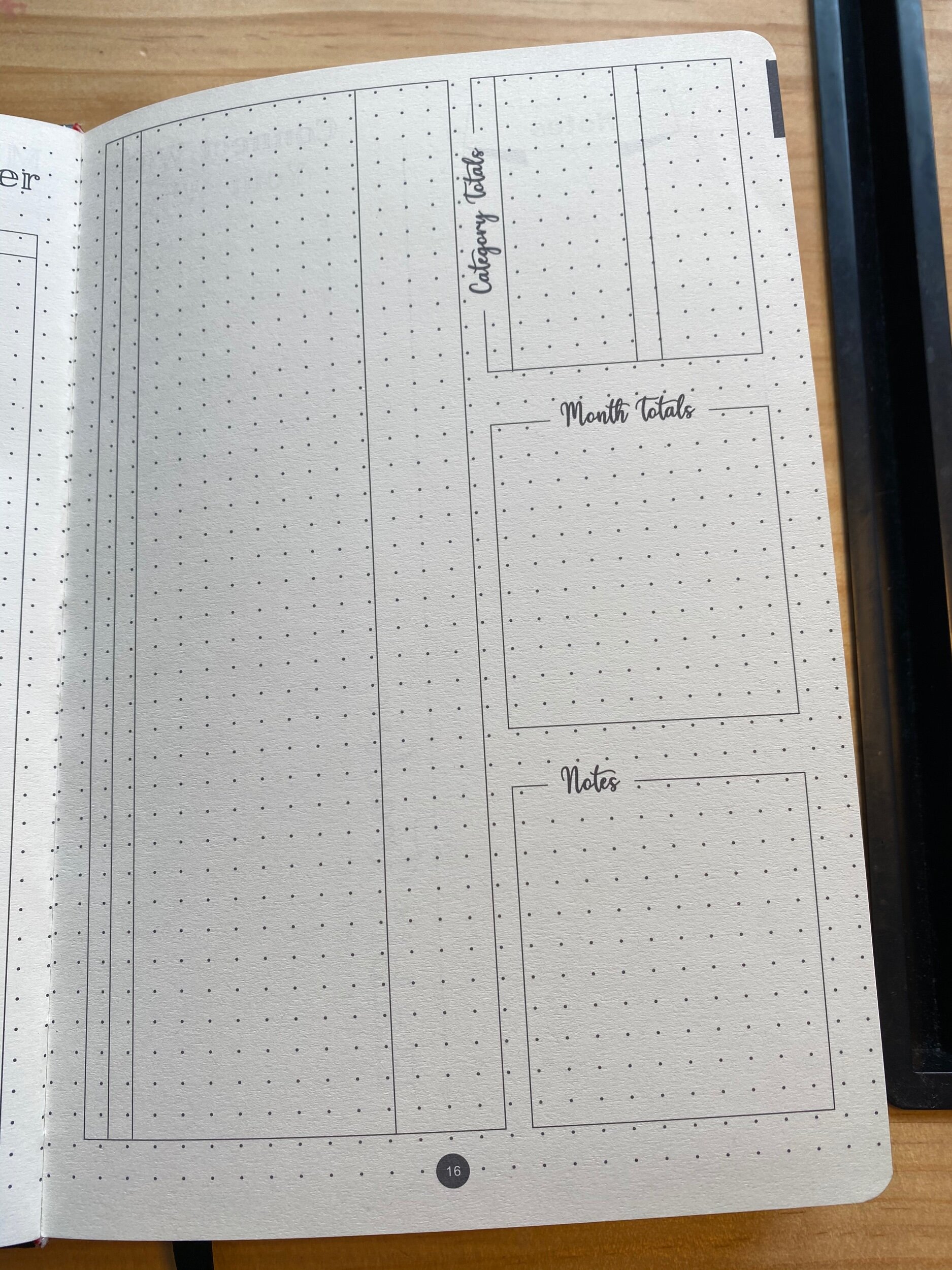

The notes box is great for a quick snapshot of larger purchases made or large savings or something coming up that month.

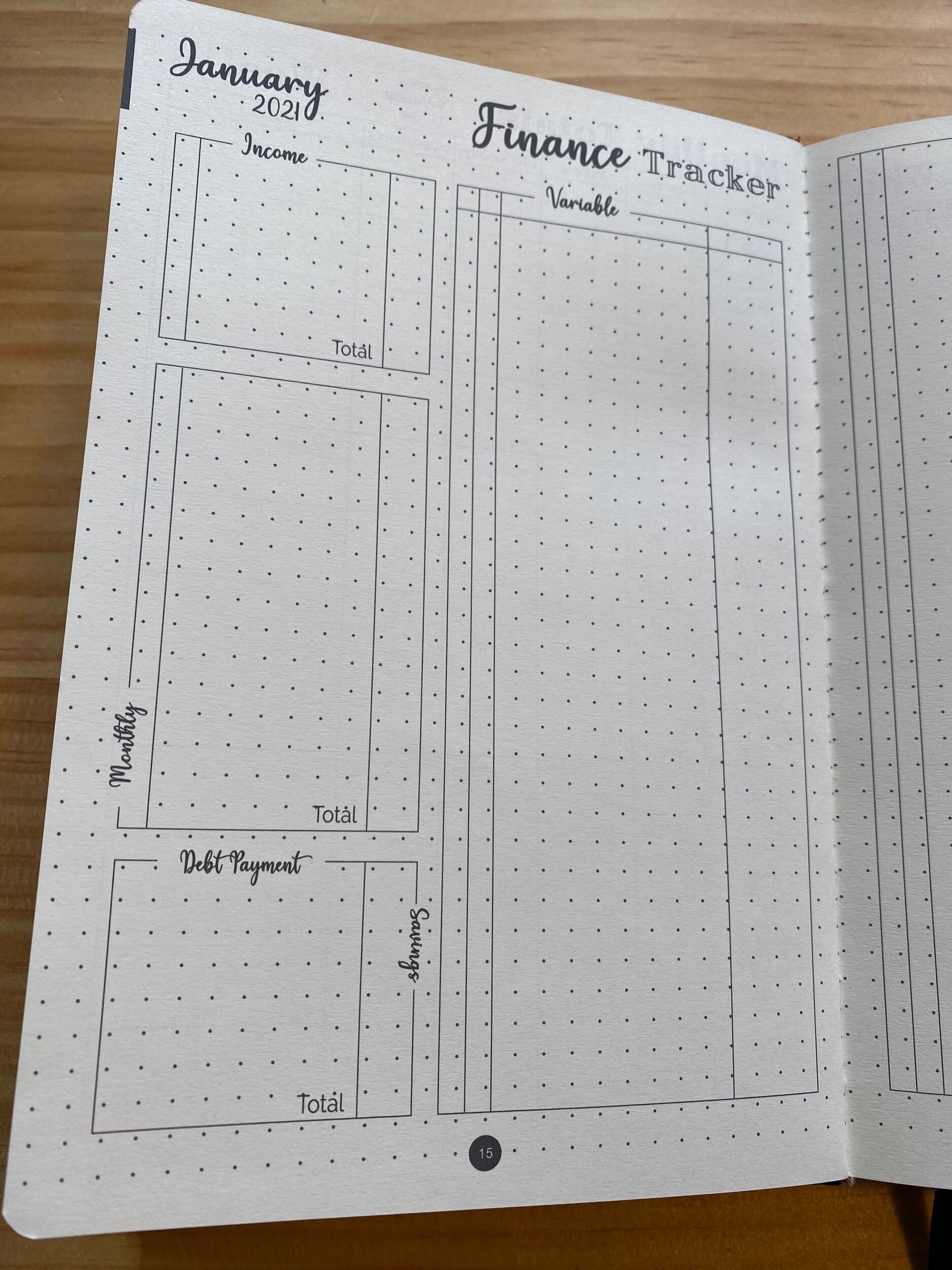

Space for income, debt repayment/savings and variable & fixed or recurring expenses.

Record monthly category totals here for an annual overview to help with understanding your spending habits/patterns and resetting your goals for the following year.

Record monthly totals and investment values here to give quick snapshot and overview to check in anytime and to inspire you to keep striving for and hitting your financial goals.